Washington/Paříž – Americký prezident Donald Trump naznačil, že USA zastaví mírové rozhovory, pokud Rusko nebo Ukrajina budou příliš ztěžovat uzavření dohody, napsala agentura Reuters. Podle agentury AP šéf Bílého domu také prohlásil, že se jednání dostala do kritické fáze a také že s ním nikdo nemanipuluje, pokud jde o snahy konflikt ukončit. Válku rozpoutalo Rusko invazí na Ukrajinu v únoru 2022.

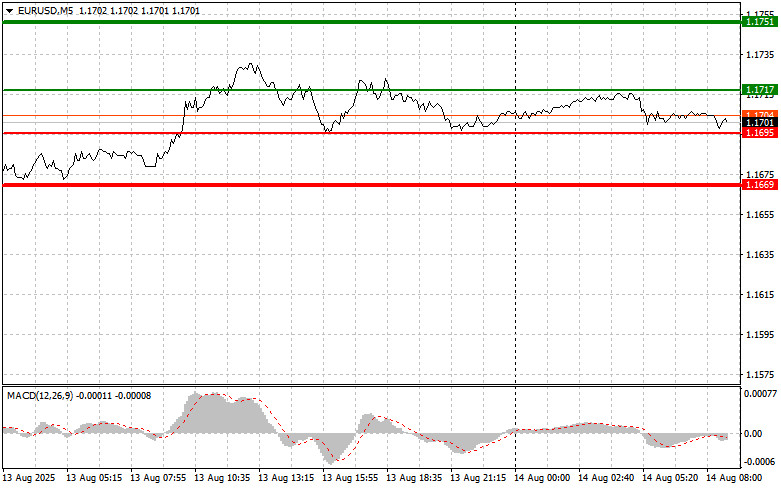

The test of the 1.1710 price level occurred at a time when the MACD indicator was starting to move down from the zero mark, which confirmed the correct entry point for selling the euro and resulted in a 15-point drop.

The European currency continued to show signs of strength, maintaining its upside potential. Yesterday's conflicting statements from Federal Reserve officials allowed the euro to retain a leading position. Despite the restrained comments from some Fed members, the overall situation remains unclear. Goolsbee, advocating for decision-making based on current data, emphasized that further policy will depend on incoming economic information. This, in turn, increases market volatility and makes the euro an attractive target for speculative trades. Other Fed representatives supported a softer policy, provided that the labor market continues to show signs of slowing.

Today, traders will focus on the European economy. The key event will be the release of updated euro area GDP data for the second quarter. This report will provide important information about the pace of economic recovery. Special attention will be given to changes in employment. An increase in jobs would be a positive sign, confirming the stability of the labor market and consumer confidence. At the same time, slower employment growth could signal potential economic problems and negatively affect the euro. Also important is the report on industrial production for June. This indicator reflects the state of the economy, showing demand and supply dynamics in the manufacturing sector. Forecasts point to modest growth, but any unexpected results could cause significant fluctuations in the currency market.

For intraday strategy, I will focus primarily on Scenarios #1 and #2.

Scenario No. 1: Today, buying the euro is possible when the price reaches around 1.1717 (green line on the chart) with a target of rising to 1.1751. At 1.1751, I plan to exit the market and also sell the euro in the opposite direction, aiming for a 30-35-point move from the entry point. Euro growth can be expected within the observed upward trend. Important! Before buying, ensure the MACD indicator is above the zero mark and starting to rise from it.

Scenario No. 2: I also plan to buy the euro today if there are two consecutive tests of the 1.1695 price level at a time when the MACD indicator is in the oversold area. This will limit the pair's downside potential and lead to an upward reversal. Growth can be expected toward the opposite levels of 1.1717 and 1.1751.

Scenario No. 1: I plan to sell the euro after reaching the 1.1695 level (red line on the chart). The target will be 1.1669, where I intend to exit the market and immediately buy in the opposite direction (expecting a 20-25-point move in the opposite direction from the level). Strong pressure on the pair is possible today after the release of weak data. Important! Before selling, ensure the MACD indicator is below the zero mark and is just starting to move down from it.

Scenario No. 2: I also plan to sell the euro today if there are two consecutive tests of the 1.1717 price level at a time when the MACD indicator is in the overbought area. This will limit the pair's upside potential and lead to a reversal downward. A decline can be expected toward the opposite levels of 1.1695 and 1.1669.

QUICK LINKS