Akcie Capital One v pondělí před zahájením obchodování rostou poté, co americké regulační orgány schválily akvizici banky Discover Financial v hodnotě 35 miliard dolarů.

Akcie se po rozhodnutí Federálního rezervního systému a Úřadu pro kontrolu měny obchodují o 3,8 % výše.

Transakce, která má nyní povolení k uzavření 18. května, podle analytiků poskytne Capital One (NYSE:COF) kontrolu nad platební sítí Discover a dlouhodobé strategické výhody.

„Dohodu považujeme za pozitivní pro COF, která přináší dlouhodobé strategické výhody a zároveň je atraktivní z finančního hlediska,“ napsala Bank of America ve zprávě klientům a ponechala na akciích rating Buy.

Wells Fargo dodala, že schválení „by mělo podpořit mnohonásobnou expanzi a více než 15% navýšení zisku na akcii v roce 27“, přičemž díky fúzi získá Capital One „globální platební síť“ a potenciál „expandovat do oblastí ‚mimo bankovnictví‘“.

Tento krok také připravuje půdu pro širší konsolidaci bank. „Investoři se domnívají, že schválení transakce COF/DFS odstartuje další bankovní fúze a akvizice,“ napsala Wells Fargo.

Firma dodala, že transakce odráží „zálohu na zlepšení regulačního prostředí ze strany nové administrativy“.

In a thin summer market, where trading volumes on the New York Stock Exchange have fallen to their lowest levels since early May, even a single company can drag the rest down. Especially when that company is NVIDIA, the tech giant's 3.5% decline made investors forget about the 350 issuers whose shares closed in positive territory, the S&P 500 and other stock indices moved sharply south. Naturally, the hardest hit was the Nasdaq 100, which recorded its steepest drop since America's Liberation Day in April.

The themes of Donald Trump's tariffs and corporate earnings are gradually fading into the background. Investors are trying to figure out what version of Jerome Powell will appear in Jackson Hole. Judging by the rally in real estate, utilities, and consumer goods stocks, the Fed Chair is expected to strike a dovish tone. Perhaps not as dovish as the White House would like, but it is unlikely he will present himself as more of a hawk than after the July FOMC meeting.

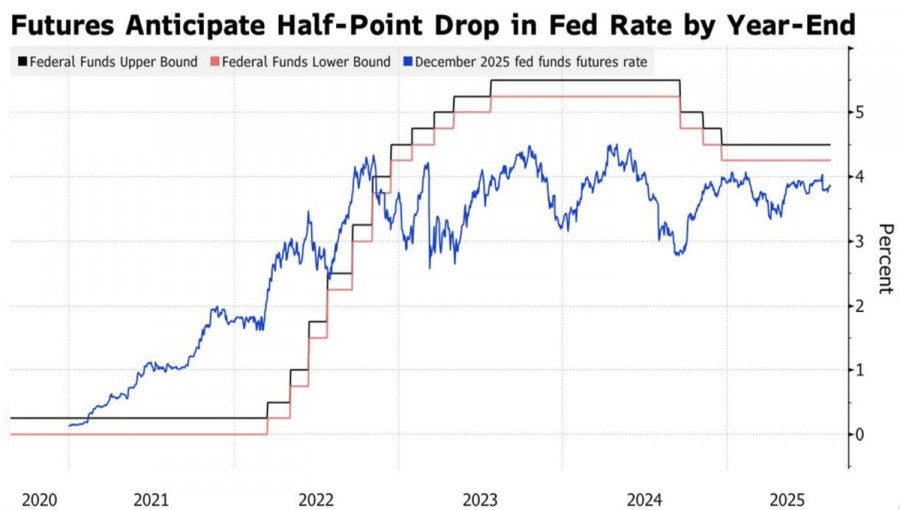

First, however, the market must pass the test of the Fed's meeting minutes. It is unlikely to focus much on what officials were thinking prior to the latest labor market data. The sharp cooling of the labor market between May and July convinced derivatives markets fully that the federal funds rate will be cut in September. Only the acceleration in producer prices reduced the probability of renewed Fed monetary easing to 83%.

The market is gradually coming back down to earth. Scott Bessent's statement on a 50 bp rate cut in September and a total of 150–175 bp in this cycle gave investors a sense of euphoria. However, Deutsche Bank and other firms argue that no models are showing such a significant divergence of the federal funds rate from its actual level.

The S&P 500's decline, triggered by NVIDIA's plunge and concerns about Powell's cautious rhetoric in Jackson Hole, coincided with Bank of America's claim of a stock market bubble. Still, the bank has made such comments before. Once a year, even a stick shoots?

In my view, the overvaluation of U.S. equities was bound to show itself sooner or later. The Nasdaq 100, for instance, is trading at 27 times expected earnings. It is vulnerable to a pullback. Why shouldn't NVIDIA and Powell trigger a correction?

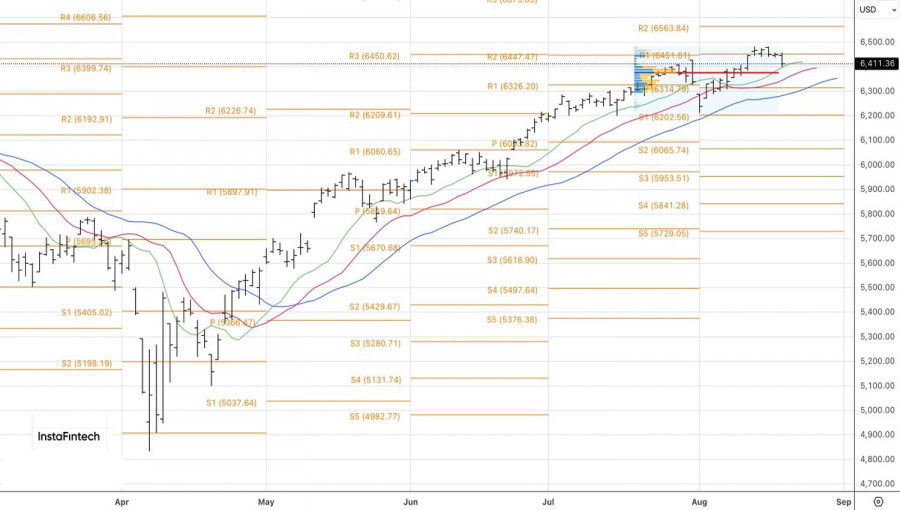

Technically, on the daily S&P 500 chart, the battle for the pivot level at 6450 ended in victory for the bears. Traders could have opened short positions from this level or on a breakout of the lower boundary of the 6435–6480 consolidation range. It makes sense to add to shorts if support at 6395 is breached. A test of fair value at 6375, however, will help clarify the broader stock index's further trajectory.

QUICK LINKS