The GBP/USD currency pair also posted quite strong growth on Thursday, even though it experienced a decline in the first half of the day. However, this drop allowed a second extremum to form on the hourly chart, which ultimately resulted in the development of an ascending trendline. So, as the saying goes, "all's well that ends well." The British pound is growing again—because, at this stage, it has no other realistic option. The US inflation report could theoretically have supported the greenback, since inflation increased in August, which may prompt the Fed to cut rates a bit more slowly. However, we were warning that inflation is not currently influencing the Fed's monetary policy—the US labor market is the primary focus for the Fed right now.

In the UK, it's been an absolute lull this week. The first reports will be published only on Friday, and even then, they are not likely to change trader sentiment much. These are the monthly GDP and industrial production figures. Monthly GDP is unlikely to attract much attention, and industrial output is not a particularly important indicator—especially for Britain. So even if the pound falls slightly on these reports, the decrease will probably be minor.

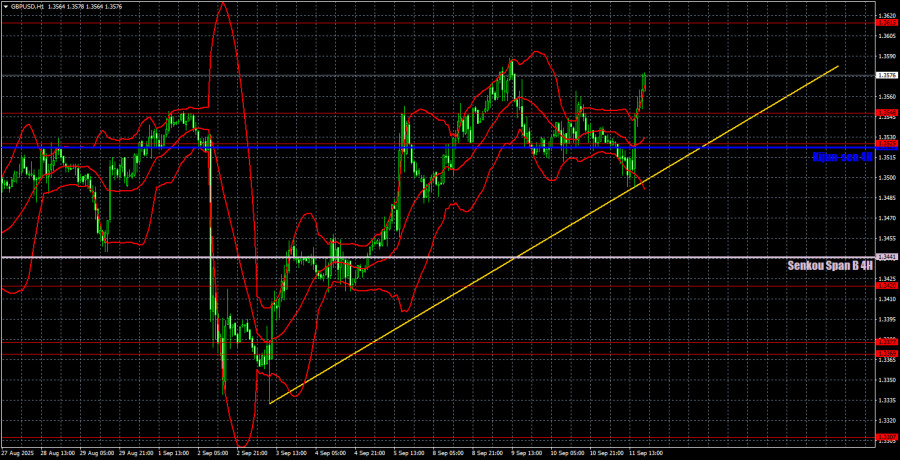

Yesterday on the 5-minute chart, three buy signals were formed near the Kijun-sen line. During the US session, there was a breakout of the 1.3525-1.3548 area. So, during the European session, traders could open long positions, even though there were at least two dangerous moments when the price tried to settle below the critical line. Still, in the end, the pair delivered the expected growth.

COT reports for the British pound show that in recent years, commercial traders' sentiment has constantly shifted. The red and blue lines—representing commercial and non-commercial net positions—constantly cross and, in most cases, are close to zero. Right now, they are at about the same level, which indicates roughly equal positions for buying and selling.

The dollar continues to decline due to Trump's policies, making demand from market makers for the pound sterling less significant at this time. The trade war will continue in some form for a long while. The Fed will cut rates anyway in the coming year. Dollar demand, one way or another, will fall. According to the latest pound sterling report, the "Non-commercial" group opened 600 BUY contracts and 1,800 SELL contracts. Thus, the net non-commercial position decreased by 1,800 contracts during the week.

GBP surged in 2025, but it's crucial to note that the primary factor was Trump's policy. As soon as that factor is neutralized, the dollar may rise again, but when is anyone's guess. No matter how fast or slow net positioning in the pound grows or falls, it's the dollar that keeps dropping—and usually at a faster rate.

On the hourly timeframe, GBP/USD is preparing to form a new uptrend—and is currently doing so. Fundamental and macroeconomic backgrounds remain unfavorable for the dollar, so there is still no reason to expect its medium-term growth.

For September 12, we highlight the following important levels: 1.3125, 1.3212, 1.3369-1.3377, 1.3420, 1.3525-1.3548, 1.3615, 1.3681, 1.3763, 1.3833, 1.3886. The Senkou Span B (1.3441) and Kijun-sen (1.3522) lines can also generate signals. It is recommended to set your Stop Loss to break even once the price moves 20 pips in the right direction. The Ichimoku indicator lines may move throughout the day; this should be considered when working with trading signals.

On Friday, the first UK reports of the week are due, but they cannot be called significant. As such, the market's reaction may be minimal or even non-existent. In the US, the interesting University of Michigan Consumer Sentiment Index will be released, and the reaction will depend on how much the actual number deviates from the forecast.

We believe that on Friday, the uptrend may continue, as practically all factors point in that direction. The target is 1.3615. We expect the pound's growth to continue above this level as well.

QUICK LINKS