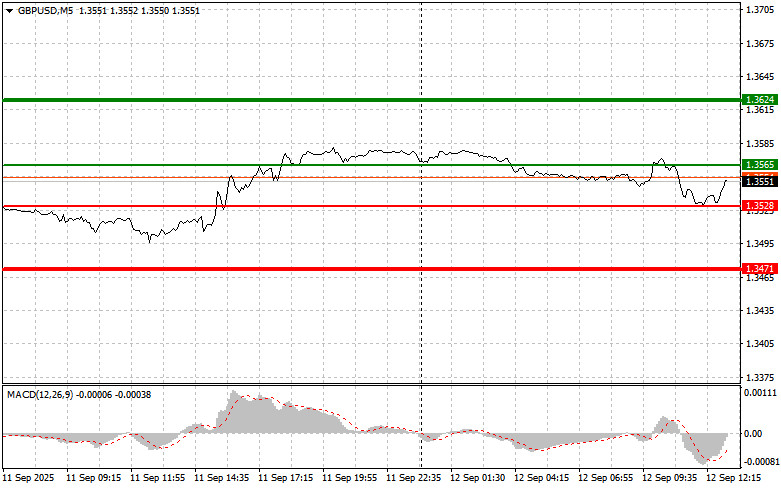

The test of the 1.3548 level came when the MACD indicator had just started moving down from the zero line, confirming a correct entry point for selling the pound. As a result, the pair dropped by 20 pips.

There was no reaction to the UK GDP data. The report fully matched economists' forecasts, recording zero growth for the past month. The market seemed to have already priced in this scenario, keeping investors focused on more pressing issues like inflation and geopolitical tensions. Zero GDP growth highlights the fragility of the British economy, calling further growth prospects into question and putting pressure on the Bank of England, which now must balance the need to contain inflation with the risk of stifling an economic upswing.

For the second half of the day, the only important data expected are the University of Michigan Consumer Sentiment Index and inflation expectations. Weak US data will help the pound rise against the dollar. If the sentiment index disappoints, indicating lower consumer confidence and higher inflation worries, it will add to the evidence that the American economy is slowing. Economic weakness, in turn, may force the Federal Reserve to adopt a more cautious stance on interest rates. For the pound, this could provide a lifeline, as a narrowing of the rate differential between the US and UK would make the pound more attractive for investors and ease pressure on the British currency.

As for the intraday strategy, I will focus more on implementing scenarios #1 and #2.

Scenario 1: I plan to buy the pound today if the price reaches the entry area around 1.3565 (green line on the chart), targeting a rise to 1.3624 (the thicker green line on the chart). Around 1.3624, I will exit long positions and open shorts in the opposite direction, expecting a 30–35 pip move back from that level. A strong rally in the pound is likely only after weak US data. Important: Before buying, make sure MACD is above zero and starting to rise.

Scenario 2: Buying the pound is also possible after two consecutive tests of the 1.3528 price when the MACD is in the oversold region. This will limit the pair's downside and could trigger an upward reversal. A rise towards 1.3565 and 1.3624 can be expected.

Scenario 1: I plan to sell the pound after moving below the 1.3528 level (red line on the chart), which will trigger a quick drop in the pair. The main target for sellers will be 1.3471, where I would exit shorts and immediately buy in the opposite direction, looking for a 20–25 pip bounce from that level. The pound could drop further if the US data is strong. Important: Before selling, make sure MACD is below zero and starting to decline.

Scenario 2: I'll also consider selling the pound after two consecutive tests of the 1.3565 level when MACD is in the overbought region. This will limit the pair's upside and could lead to a reversal downwards. Look for a move to 1.3528 and then 1.3471.

Thin green line – entry price at which the instrument can be bought.

Thick green line – suggested price for taking profit or manually securing profits, as further growth above this level is unlikely.

Thin red line – entry price at which the instrument can be sold.

Thick red line – suggested price for taking profit or manually securing profits, as further decline below this level is unlikely.

MACD indicator: When entering the market, it is important to refer to overbought and oversold areas.

Important. Beginner forex traders should exercise extreme caution when making entry decisions. Before important fundamental reports, it is best to stay out of the market to avoid sharp price swings. If you decide to trade during the release of news, always use stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit, especially if you don't use money management and trade large volumes. And remember: for successful trading, you need a clear trading plan, as I described above. Making spontaneous trading decisions based on the current market situation from moment to moment is a losing strategy for an intraday trader.

QUICK LINKS