The Fed is set to cut rates in September—a situation painfully reminiscent of last year. Back then, the central bank also cited labor market weakness and began a cycle of monetary easing. Deja vu? In reality, there are plenty of differences from 2024. These differences mean it's not safe to assume the Fed will act at the same speed—or that EUR/USD will follow the previous path.

Job creation in the US over the summer has slowed to an average of only 29,000 per month compared to 100,000 in the first quarter. Unemployment, on the other hand, is rising very slowly—not like in 2024, when it jumped by 0.6 percentage points and forced the Fed to cut rates. Clearly, the main reason for labor market weakness now is Donald Trump's anti-immigration policy.

Inflation dynamics are also fundamentally different. At the end of last year, inflation was slowing; now, it's rising because of tariffs. Still, the Fed believes the spike in consumer prices is temporary, so with or without political pressure from the White House, it intends to cut rates. These expectations are driving Treasury yields lower. In theory, this should weaken the US dollar. Yet, EUR/USD bulls are in no hurry to push the pair higher.

Why not? In my view, the derivatives market has become too focused on the end of the ECB's monetary easing cycle and on the idea of three Fed rate cuts in 2025. Derivatives currently price only a 40% chance of a European Central Bank deposit rate cut by mid-2026. However, France's central bank chief Francois Villeroy de Galhau thinks another step toward easing can't be ruled out. His colleagues from Lithuania and Latvia are also keeping the door open.

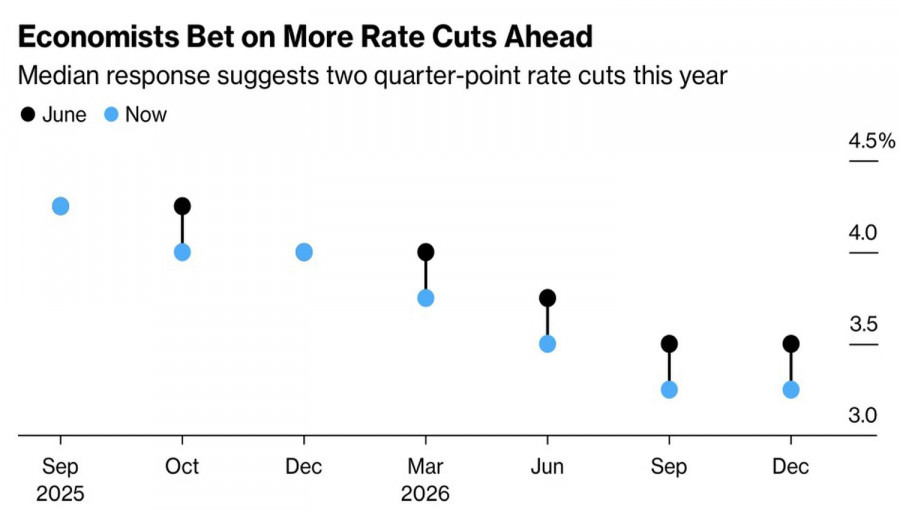

This split within the ECB Governing Council is bothering EUR/USD bulls, as is Bloomberg's updated expert forecast for Fed policy. The average projection now calls for two rate cuts in 2025, with just 40% of respondents expecting three. The derivatives market, meanwhile, is over 80% confident in a 75 bp cut in borrowing costs this year.

Amundi agrees, expecting three rounds of monetary easing from the Fed and two from the ECB. The argument is that the eurozone economy is weak and needs support, and the ECB will be more comfortable easing policy if the Fed is also doing so.

Thus, markets are racing ahead, betting on major divergences in the pace of ECB and Fed rate cuts. But in reality, the outlook isn't so clear.

On the daily EUR/USD chart, the bounce from fair value and dynamic supports, like the moving averages, seemed to hand the initiative back to the bulls. However, the bears do not intend to surrender. The fate of the main currency pair depends on its ability to escape the 1.163–1.173 range. If it manages to consolidate above 1.173, there will be an opportunity for increased long positions.

QUICK LINKS