The EUR/USD currency pair once again traded calmly on the second trading day of the week. While there was a minor intraday upward bias on Monday, it remained weak, accompanied by low volatility. Now that it's October 1 — and there's a 95% chance the U.S. government will shut down along with all federal agencies — the dollar's reaction to negative news is surprisingly modest. In fact, we would say it isn't reacting at all.

Is this justified? Of course not. Even without the shutdown threat, there are already plenty of solid reasons for the dollar to be falling. While the pair has undergone a correction over the last two weeks, the fundamental and macroeconomic backdrop has not changed. And most importantly, Donald Trump's policy direction hasn't changed either. The "New Shutdown," courtesy of Trump, might differ from previous ones in that, instead of sending federal workers on unpaid leave — as in the past — they'll simply be fired. At least, that's what Trump himself suggested.

We find this highly unlikely, as it simply doesn't make sense. Why fire tens of thousands of government employees only to hire others one or two months later? Most likely, workers will be placed on unpaid leave as before. The threat of mass layoffs is simply a political pressure tactic aimed at Democrats. That way, Trump will be able to shift blame by saying the Democrats are responsible — something he's already doing in various interviews.

This time, the sticking point is social and healthcare programs. Democrats are demanding a partial repeal of Trump's "Big, Beautiful Bill," which was passed earlier without their input. Let's recall that the Republican Party currently has enough votes in both chambers of Congress to enact legislation unilaterally. However, within the Republican Party itself, decisions are essentially made by one person — Trump. As a result, he now holds a near "super-power" status.

However, when it comes to passing the federal budget, at least 60 votes are required in the Senate. The Republicans have only 53 reliable votes in the upper chamber, so they cannot pass the budget alone. The Democrats have sensed weakness and are now seizing this opportunity to push back against a series of Trump-era policies.

Let's not forget that midterm elections for the House of Representatives are scheduled for next year, and the Republicans are widely expected to lose their majority. Of course, this is speculation — but can anyone honestly claim the average American is happy with the current situation? Historically, the Republican Party represents the interests of the wealthy, and wealthy Americans aren't struggling under Trump. They don't care about cutting funding for social and healthcare programs, especially since their tax cuts were significantly larger than those offered to the working class. This is why Democrats now see it as essential to show they are willing to fight for the rights and freedoms of ordinary Americans rather than cooperate with Trump unconditionally.

As a result, this shutdown could drag on for quite some time.

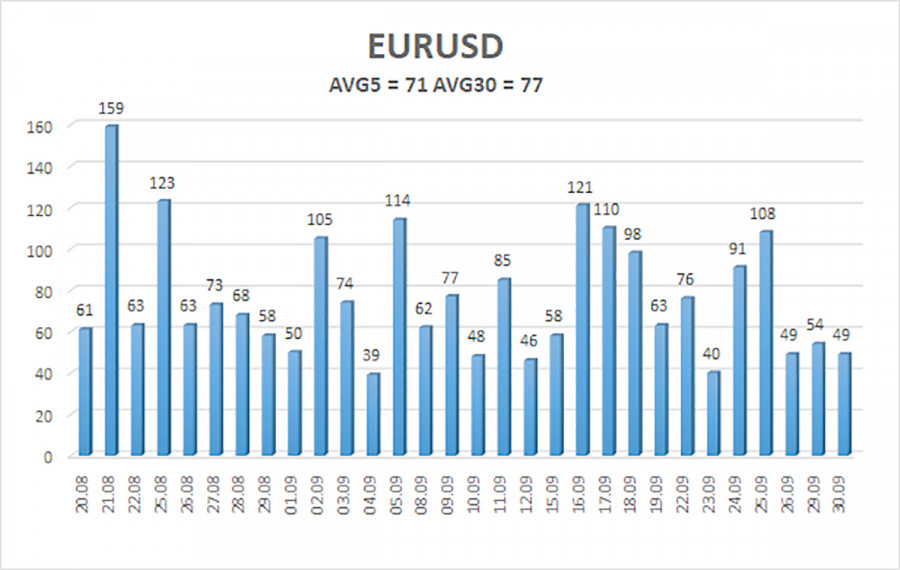

The average volatility of the EUR/USD pair over the last five trading days (as of October 1) is 71 pips, which is considered "moderate." We expect price movement within the range of 1.1660 to 1.1802 on Wednesday. The longer-term linear regression channel still points upward, indicating a continued uptrend. The CCI indicator recently entered overbought territory, triggering the latest round of downward correction.

The EUR/USD pair remains in a corrective phase; however, the broader uptrend remains intact across all timeframes. The U.S. dollar continues to face strong headwinds from Donald Trump's erratic policymaking — and he doesn't seem to be slowing down. The dollar spent a whole month pushing higher, but it now appears the market is preparing for another prolonged downward leg.

QUICK LINKS