Prezident Donald Trump musí brzy oznámit vítězství v obchodních válkách po celém světě, jinak riskuje vyvolání recese, která by mohla stát republikány jejich těsné většiny v Kongresu, uvedli analytici společnosti Yardeni Research.

„Prezident Donald Trump bude muset co nejdříve vyhlásit vítězství v obchodních válkách, které vede s několika zeměmi po celém světě,“ napsala společnost. „On a jeho kolegové republikáni se musí vyhnout recesi způsobené jeho celními válkami.“

Firma dále upozornila, že narůstá i právní tlak. Yardeni uvedl: „Hromadí se soudní případy, které zpochybňují prezidentovu zákonnou pravomoc vyhlásit krizi jako ospravedlnění pro zvýšení cel.“

Domnívají se, že případné rozhodnutí proti tarifům by mohlo Trumpovi poskytnout elegantní cestu ven: „Stále může prohlásit, že v obchodních válkách zvítězil, a proto už cla nejsou potřeba.“

Trhy reagovaly na známky pokroku pozitivně. „Dne 9. dubna byli investoři na akciovém trhu nadšeni, když Trump odložil odvetná cla, která měla vstoupit v platnost 2. dubna na tzv. Den osvobození,“ uvedla firma a dodala, že index S&P 500 „získal zpět téměř všechny ztráty“ z počátku dubna, kdy došlo k tzv. „dním zničení“.

Nedávná oznámení – včetně obchodní dohody USA a Velké Británie a nadcházejících jednání s čínskými představiteli – pomohla udržet dynamiku na trzích.

Yardeni však varoval, že „akciový trh brzy pocítí únavu z dohod a Trumpových prohlášení o vítězství“.

Společnost očekává, že obchodní napětí do léta poleví: „Domníváme se, že otázka obchodu bude vyřešena do července nebo srpna,“ napsala firma.

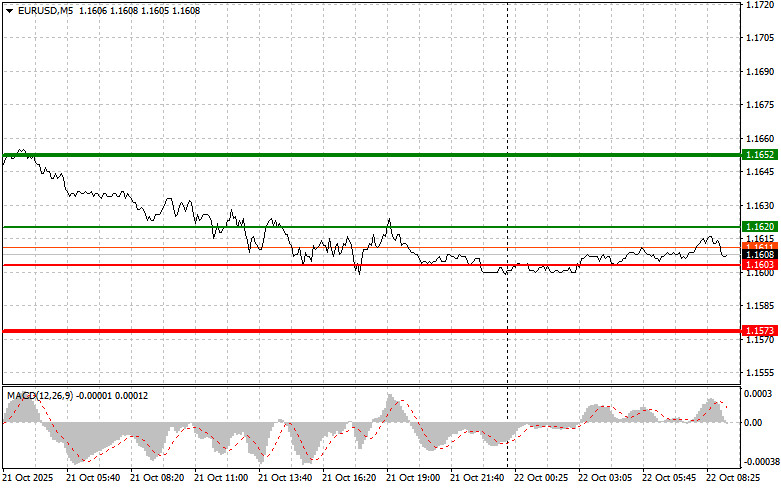

The price test of 1.1606 occurred when the MACD indicator had already moved significantly below the zero mark, limiting the pair's downward potential. For this reason, I did not sell the euro. The second test of this level occurred when the MACD indicator was in the oversold zone, triggering Scenario #2 for buying the euro, which resulted in a 20-pip rise in the euro's value.

President Trump's inconsistent approach to resolving trade disputes with China continues to keep investors from active operations with the euro. Uncertainty about the possibility of reaching a full-fledged trade agreement negatively affects market sentiment, with participants preferring to observe rather than act. One moment, Trump states he's ready to meet with Xi, and then a few hours later, he says he intends to impose 155% tariffs on China starting November 1.

Today, no economic data is scheduled to be published in the Eurozone during the first half of the day, which automatically shifts attention to the speech by European Central Bank President Christine Lagarde. Traders will pay close attention to her comments regarding future inflation trends, economic growth, and subsequent monetary policy actions. Market participants are looking for hints on how concerned the central bank is about pricing and its willingness to implement further monetary stimulus if needed.

In addition to Lagarde's speech, investors will also be following developments from the US and China regarding the status of a trade agreement.

For the intraday strategy, I will rely primarily on the execution of Scenarios #1 and #2.

Important: Beginner traders on the Forex market must be very cautious when making entry decisions. Before the release of key fundamental reports, it is generally best to stay out of the market to avoid sudden price swings. If you choose to trade during news events, always place stop-loss orders to minimize losses. Without stop-loss protection, you could quickly lose your entire deposit—especially if you do not use money management and trade with high volumes.

Remember: successful trading requires a clear trading plan, such as the one outlined above. Spontaneous decision-making based on the current market situation is an inherently losing strategy for intraday traders.

QUICK LINKS