Trade Analysis and Tips for Trading the Japanese Yen

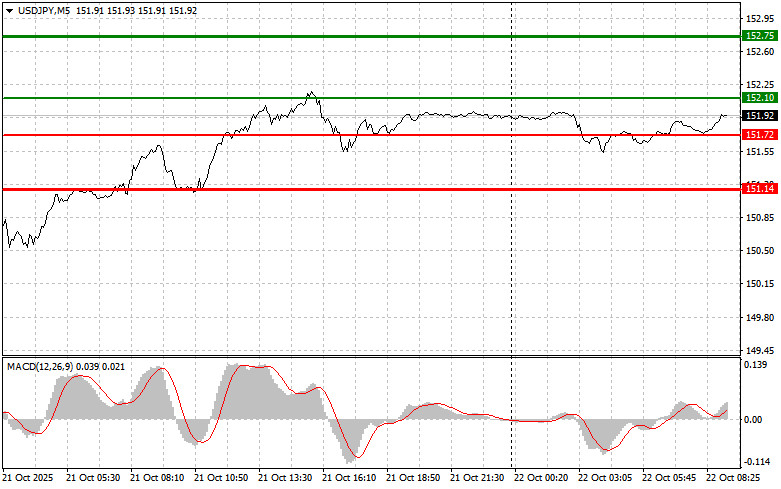

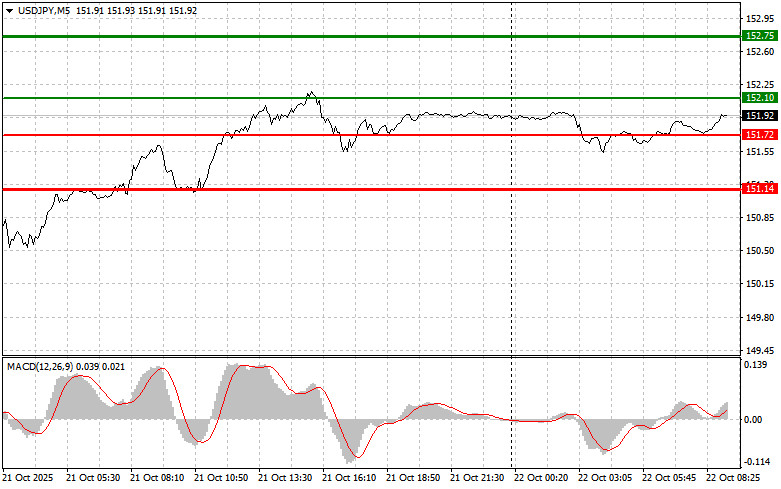

The test of the 151.66 level occurred when the MACD indicator had already moved significantly below the zero mark, limiting the pair's downward potential. For this reason, I did not sell USD/JPY.

The primary pressure on the Japanese yen continues to be the new Prime Minister's willingness to return to economic stimulus and support measures—an approach that contrasts with the Bank of Japan's potential plans to raise interest rates. This dichotomy creates significant uncertainty in financial markets. On one hand, stimulus efforts aimed at reviving the economy could lead to increased inflation and a weakening of the yen. On the other hand, rate hikes intended to control inflation might slow economic growth and also pressure the yen if perceived as premature or excessive.

Therefore, it is necessary to closely monitor the actions of both the government and the central bank to try to assess which course will dominate. Their decisions directly influence the supply and demand for the yen and thus impact its value. External factors such as the global economic situation and U.S. trade policy further complicate the outlook.

For the intraday strategy, I will primarily focus on the execution of Scenarios #1 and #2.

Buy Scenarios

- Scenario #1: I plan to buy USD/JPY today upon reaching the entry point around 152.10 (green line on the chart), targeting a rise to the 152.75 level (thicker green line on the chart). Around 152.75, I plan to exit the long position and open a short position in the opposite direction (expecting a move of 30–35 pips in the opposite direction). It's advisable to return to buying the pair on pullbacks and deep corrections in USD/JPY.

- Important: Before buying, make sure the MACD indicator is above the zero line and just starting to rise from it.

- Scenario #2: I also plan to buy USD/JPY today if there are two consecutive tests of the 151.72 level while the MACD indicator is in the oversold zone. This will limit the pair's downside potential and trigger a reversal to the upside. Growth can then be expected toward the 152.10 and 152.75 levels.

Sell Scenarios

- Scenario #1: I plan to sell USD/JPY today only after a breakout below the 151.72 level (red line on the chart), which may lead to a swift decline in the pair. The key target for sellers will be the 151.14 level, where I plan to exit short positions and immediately open long positions in the opposite direction (expecting a reversal move of 20–25 pips). It's best to sell as high as possible.

- Important: Before selling, make sure the MACD indicator is below the zero line and just beginning to decline from it.

- Scenario #2: I also plan to sell USD/JPY today in the event of two consecutive tests of the 152.10 level while the MACD indicator is in the overbought zone. This would limit the pair's upward potential and result in a reversal to the downside. A decline can then be expected toward the 151.72 and 151.14 levels.

What's on the Chart:

- Thin green line – entry price to buy the trading instrument

- Thick green line – projected price for placing Take Profit or manually exiting long positions (further growth beyond this point is unlikely)

- Thin red line – entry price to sell the trading instrument

- Thick red line – projected price for placing Take Profit or manually exiting short positions (further decline below this point is unlikely)

- MACD Indicator – when entering trades, it's important to follow overbought and oversold zones

Important: Beginner traders on the Forex market must be very cautious when making entry decisions. Before the release of key fundamental reports, it is generally best to stay out of the market to avoid sudden price swings. If you choose to trade during news events, always place stop-loss orders to minimize losses. Without stop-loss protection, you could quickly lose your entire deposit—especially if you do not use money management and trade with high volumes.

Remember: successful trading requires a clear trading plan, such as the one outlined above. Spontaneous decision-making based on the current market situation is an inherently losing strategy for intraday traders.