Relatively important data may play a role. This is how the dollar's prospects look for next week. There will be a few U.S. reports, but there are still no alternatives. In America, I can highlight the Producer Price Index, retail sales, and durable goods orders as interesting reports. There is also a whole list of reports that were supposed to be released, but it seems the Bureau of Statistics will not provide them.

I remind you that the U.S. Bureau of Statistics only resumed its work last week and is currently busy filling in the gaps for October and November. To be more precise, it hasn't even reached November yet, and the October reports for September are already of little interest to anyone. Therefore, U.S. data for September will likely not attract much attention. If this assumption is correct, the market is unlikely to find grounds for selling among them.

However, the dollar has maintained relatively high demand over the past two months, with only extremely weak support or none at all. The wave labeling for the EUR/USD and GBP/USD instruments suggests the formation of an upward wave set, but the price increase could have started either a week ago or back in August. All this time, the market has ignored events that fully align with the wave picture. Therefore, even if U.S. data turn out to be weak next week, it does not mean we will see an increase in both instruments. However, this is something we want to believe in.

Based on the analysis conducted for EUR/USD, I conclude that the instrument continues to build an upward section of the trend. In recent months, the market has paused, but the policies of Donald Trump and the Federal Reserve remain significant factors in the future decline of the American currency. The current section of the trend may stretch as far as the 25th figure. At this time, the formation of an upward wave set may continue. I expect that from the current positions, the third wave of this set will begin to form, which may be either with or 3. In the coming days, I am considering long positions with targets around the 1.1740 mark, and a reversal of the MACD indicator upwards will confirm this signal.

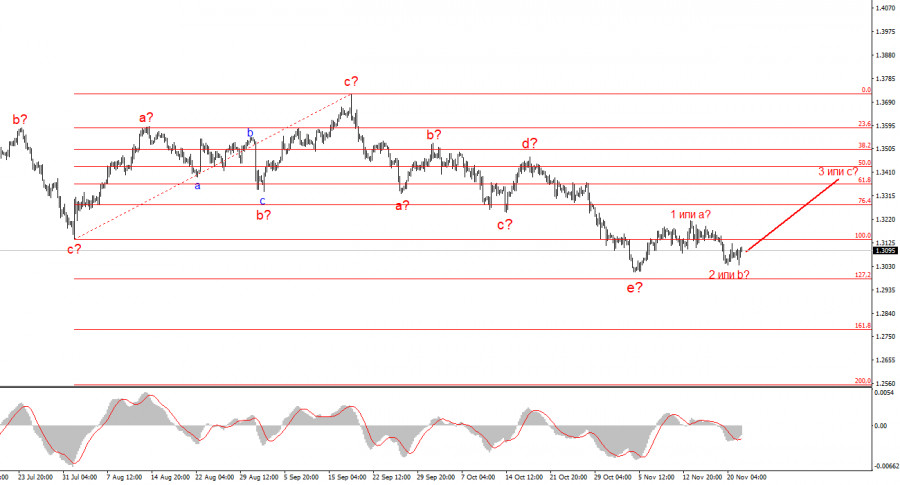

The wave picture of the GBP/USD instrument has changed. We continue to deal with the upward, impulsive section of the trend, but its internal wave structure has become increasingly complex. The downward corrective structure a-b-c-d-e in c in 4 appears quite complete. If this is indeed the case, I expect that the main section of the trend will resume its formation with initial targets around the 38 and 40 figures. In the short term, it is possible to expect the formation of wave 3 or c with targets located around the 1.3280 and 1.3360 marks, which corresponds to 76.4% and 61.8% of Fibonacci.

QUICK LINKS