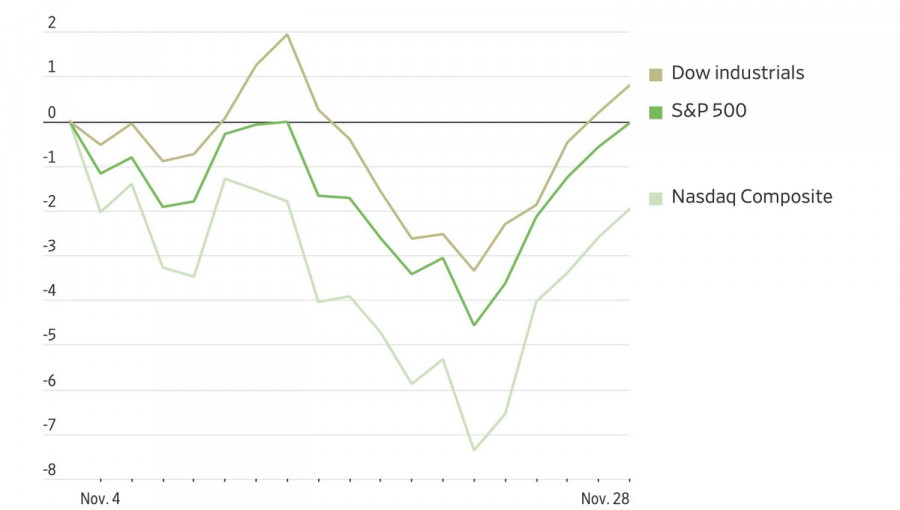

As expectations for a rate cut in the federal funds rate align with the onset of a seasonally strong period for US equities, the S&P 500 finds itself poised for growth. The broad stock index has erased much of the losses incurred during the autumn sell-off and managed to close November in positive territory, a stark contrast to the Nasdaq Composite, which recorded its first monthly decline since March.

Nasdaq Composite Monthly Performance

What transpired at the intersection of October and November? Investors are suggesting that the recent downturn represents a healthy correction. Since the anticipated collapse of the artificial intelligence bubble has yet to materialize, it may not exist at all. Moreover, the sharp shift in the likelihood of a loosening monetary policy by the Federal Reserve—from less than 30% following the release of the central bank's last meeting minutes to the current 88%—has restored confidence in the S&P 500.

Previously, markets believed the Federal Reserve would pause due to a lack of official data. However, opinions shifted as winter approached. Investors are now convinced that the central bank will provide a lifeline to a cooling labor market. Statistics from ADP and other alternative sources indicate that employment growth is indeed slowing. Furthermore, expectations are that speeches from Jerome Powell and Michelle Bowman will lean dovish, increasing the likelihood of monetary policy easing not just in December, but in January as well.

The Nasdaq Composite's decline in November was driven by a withdrawal of investors from tech stocks amid concerns about a bubble. Analysts worry that inflated fundamental valuations and the inability of tech giants to generate profits commensurate with their AI investments raise parallels to the dot-com crisis. However, recent events suggest that it is still too early for a bubble to burst.

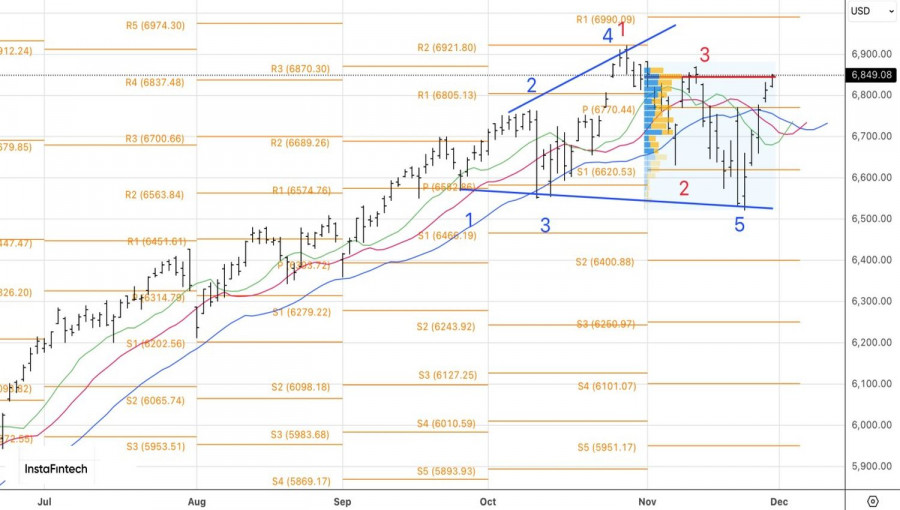

Dynamics of US Stock Indices

Market sentiment leans towards the belief that the S&P 500 is aiming for a soft landing for the US economy. If economic data begins to deteriorate, fear could return and depress the broad index. However, I consider this scenario unlikely. Stocks appear to have a safety net beneath them. The stock market can operate under conditions where poor statistics for the US economy could be interpreted as beneficial. In such a scenario, the Fed could take aggressive action.

Support for the S&P 500 is not only coming from the central bank but also from the White House. Donald Trump has indicated he has made his choice for the new Fed chairman, with an announcement expected soon—likely by Christmas, as Scott Bessent previously noted. The most likely candidate is Kevin Hassett, a close ally of the president and a proponent of aggressive cuts to the federal funds rate.

From a technical standpoint, the daily chart of the S&P 500 shows a strong potential for a reversal of the expanding wedge pattern in favor of bulls. Long positions opened on the breakout from the pivot level of 6,770 should be maintained and gradually increased, particularly if a successful advance towards fair value at 6,850 is achieved.

QUICK LINKS