Trade Analysis and Advice on Trading the British Pound

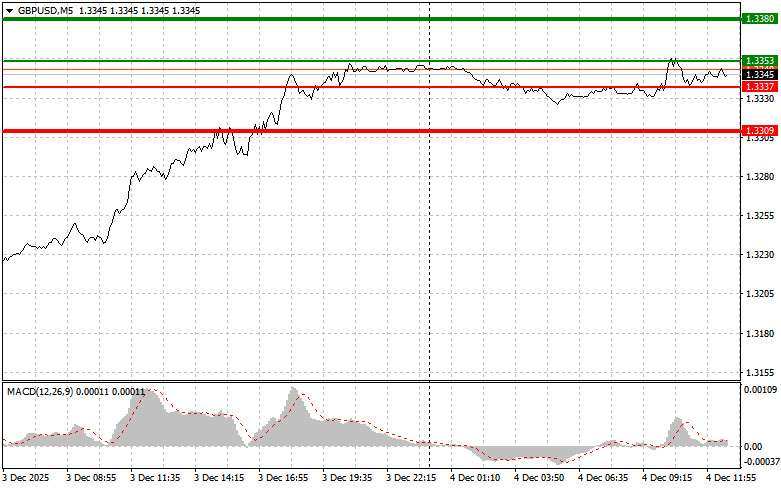

The test of the 1.3344 price level occurred when the MACD indicator had just begun moving upward from the zero mark, confirming the correct entry point for buying the pound. As a result, the pair rose by only 10 points.

A sharp decline in the UK construction sector, reflected in the drop of the index to 39.4, has negatively affected the pound sterling. The decrease in the construction PMI indicates a slowdown in economic growth, which impacts future performance. A reduction in construction volumes may trigger decreased demand for resources, slower wage growth, and, consequently, worsening consumer sentiment. This situation will inevitably influence the Bank of England's strategy as well, as it continues to maintain high interest rates, which also negatively affect activity in the construction sector.

Next, market participants will carefully analyze U.S. economic indicators, as they can clarify the current state of employment and, consequently, the possible decisions of the Federal Reserve regarding interest rates. A decrease in initial jobless claims and a reduction in layoffs would signal continued labor market resilience and help offset yesterday's negative sentiment after the ADP report. However, this is unlikely to significantly influence the Fed's decision.

As for the intraday strategy, I will rely more on scenarios No. 1 and No. 2.

Buy Signal

Scenario No. 1: I plan to buy the pound today upon reaching the entry point around 1.3353 (green line on the chart) with the goal of rising to 1.3380 (the thicker green line on the chart). Around 1.3380, I will exit long positions and open short positions in the opposite direction (expecting a 30–35-point move in the opposite direction). A strong rise in the pound today can only be expected after weak U.S. data. Important! Before buying, make sure the MACD indicator is above the zero line and only beginning to rise from it.

Scenario No. 2: I also plan to buy the pound today in the case of two consecutive tests of the 1.3337 price level at a moment when the MACD indicator is in the oversold area. This will limit the pair's downward potential and lead to a market reversal upward. Growth to the opposite levels of 1.3353 and 1.3380 can be expected.

Sell Signal

Scenario No. 1: I plan to sell the pound today after the 1.3337 level (red line on the chart) is updated, which will lead to a rapid decline of the pair. The key target for sellers will be 1.3309, where I will exit short positions and immediately open long positions in the opposite direction (expecting a 20–25-point move in the opposite direction). Pressure on the pound is unlikely to return today.Important! Before selling, make sure the MACD indicator is below the zero line and only beginning to fall from it.

Scenario No. 2: I also plan to sell the pound today in the case of two consecutive tests of the 1.3353 price level at a moment when the MACD indicator is in the overbought area. This will limit the pair's upward potential and lead to a market reversal downward. A decline to the opposite levels of 1.3337 and 1.3309 can be expected.

What's on the Chart:

Important. Beginner Forex traders must make entry decisions very carefully. Before the release of important fundamental reports, it is best to stay out of the market to avoid sharp price movements. If you decide to trade during news releases, always place stop orders to minimize losses. Without stop orders, you can lose your entire deposit very quickly, especially if you do not use money management and trade large volumes.

And remember that successful trading requires having a clear trading plan, like the one I presented above. Spontaneous trading decisions based on the current market situation are inherently a losing strategy for an intraday trader.

QUICK LINKS