Akcie společnosti Deckers Outdoor Corporation (NYSE:DECK) v pátek prudce klesly poté, co firma vydala slabší výhled na aktuální čtvrtletí, i přes lepší než očekávané výsledky za Q4.

Výrobce obuvi značek UGG a HOKA oznámil očištěný zisk 1,00 USD na akcii (odhad 0,59 USD). Tržby činily 1,02 miliardy USD, lehce nad očekáváním 1,01 miliardy USD a meziročně +6,5 %.

Značka Hoka rostla o 10 % (odhad 14,3 %), UGG o 3,6 % (odhad pokles o 4,9 %).

Výhled na Q1 fiskálního roku 2026 ale investory zklamal. Firma očekává zisk 0,62–0,67 USD na akcii (odhad 0,79 USD) a tržby 890–910 milionů USD (odhad 925,3 milionu).

Akcie v premarketu klesly o více než 17 %.

Analytici Evercore snížili doporučení na „In Line“ s odůvodněním, že růst značek HOKA a UGG zpomaluje.

KeyBanc Capital Markets snížil hodnocení na „Sector Perform“ kvůli obavám z možného poklesu poptávky v důsledku vyšších cen a posunu směrem k velkoobchodnímu prodeji.

There are very few macroeconomic reports scheduled for Monday. The only noteworthy release is the final estimate of UK GDP for the third quarter. It cannot be said that this report is secondary, but we do not expect a strong market reaction. Traders are already familiar with the first two estimates, and the third is unlikely to differ significantly from them. In the Eurozone and the U.S., the event calendars are empty.

No fundamental events are scheduled for Monday. Overall, the market currently has questions only for the Federal Reserve. The last meeting occurred recently, and since then, the U.S. has published data on the labor market, unemployment, and inflation, all of which have a significant impact on the Federal Reserve's monetary policy. Therefore, we do not have an updated perspective from Jerome Powell or other members of the FOMC. However, as mentioned earlier, there are no speeches from Fed officials planned for Monday. With the New Year approaching, many are going on holiday.

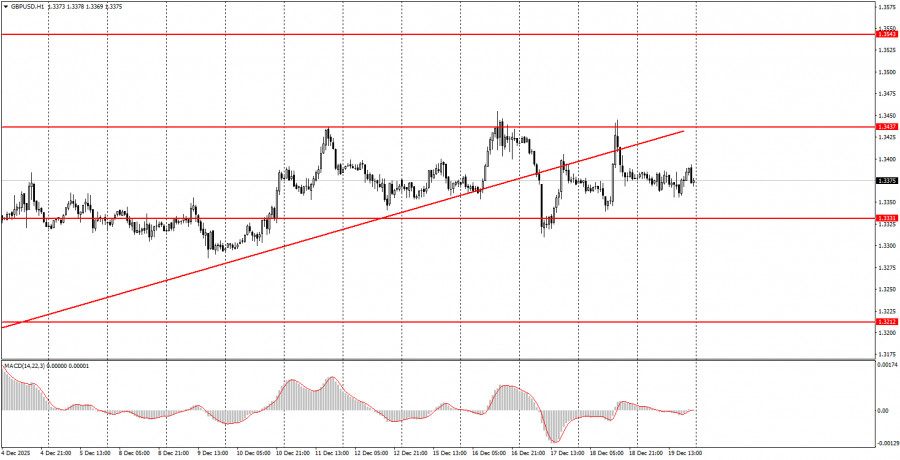

On the first trading day of the week, both currency pairs may exhibit low volatility and trade predominantly sideways. The EUR/USD pair will likely continue to trade near the 1.1745-1.1754 area, where new trading signals should be sought. The GBP/USD pair has been flat for seven days, so trading can only occur at the boundaries of the sideways channel at 1.3319-1.3446.

Important Note: Significant speeches and reports (always included in the news calendar) can greatly influence the movement of the currency pair. Therefore, during their release, it is advisable to trade cautiously or exit the market to avoid sharp reversals against the preceding movement.

Remember: For beginners trading in the Forex market, it is important to understand that not every trade can be profitable. Developing a clear strategy and practicing money management are keys to long-term trading success.

QUICK LINKS