Gold prices have reached a new all-time high, driven by escalating geopolitical tensions and expectations of further U.S. interest rate cuts. Precious metals prices have risen by more than 1.5%, surpassing the previous record of $4,413 per ounce set in October of this year.

Traders are once again betting that the Federal Reserve will cut borrowing costs twice in 2026 following a series of economic data released last week. Lowering interest rates typically benefits the prices of non-yielding precious metals.

The rise in gold prices is also supported by sustained demand from central banks, particularly in developing countries. Central banks are seeking to diversify their reserves amid fears of currency devaluation and global economic instability.

The escalation of geopolitical tensions in recent weeks has further increased the attractiveness of gold and silver as safe-haven assets. The U.S. has intensified its oil blockade against Venezuela, increasing pressure on President Nicolas Maduro's government, while Ukraine has, for the first time, attacked a Russian oil tanker in the Mediterranean.

Against this backdrop, it is not surprising that precious metals are on track for their strongest annual growth. Trump's aggressive efforts to reform global trade, along with his threats to the independence of the U.S. central bank, have further fueled the rapid price increases this year.

Platinum has risen for the eighth consecutive session and has surpassed the $2,000 mark for the first time since 2008. Platinum, which has increased by about 125% this year, has been growing rapidly, keeping pace with silver.

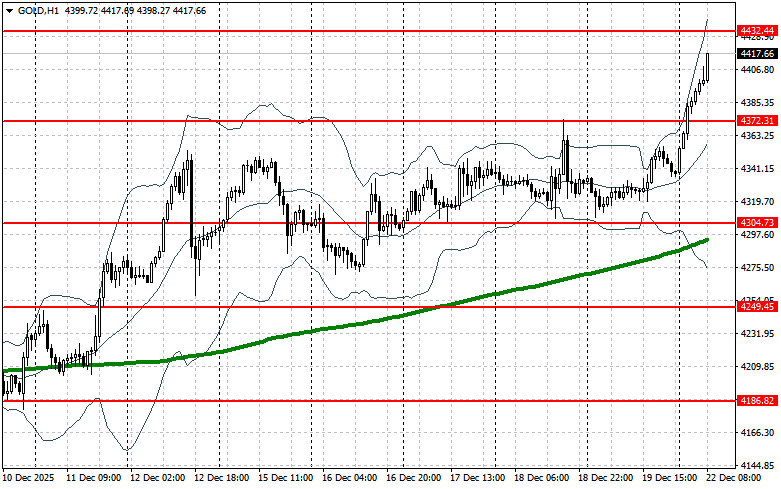

Regarding the current technical picture for gold, buyers need to surpass the nearest resistance at $4,432. This will enable targeting $4,481, above which it will be quite challenging to break through. The farthest target will be the area around $4,531. In the event of a decline, bears will attempt to regain control over $4,372. If this is achieved, a range breakout could deal a severe blow to bullish positions and push gold down to a low of $4,304, with the potential to reach $4,249.

QUICK LINKS