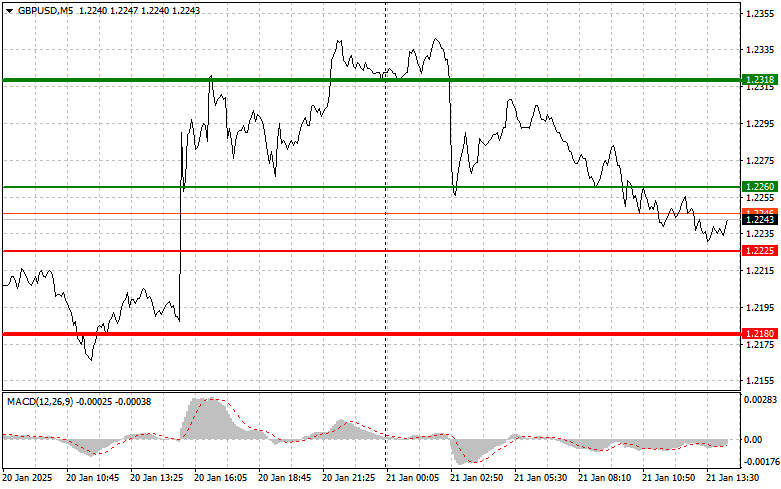

The test of the 1.2239 price level occurred when the MACD indicator had already dropped significantly below the zero line, clearly limiting the pair's downward potential. For this reason, I did not sell the pound. A second test of 1.2239 after a short interval, while the MACD was in the oversold zone, allowed Scenario #2 for buying to play out. However, as you can see on the chart, this did not lead to significant movement, as demand for the pound failed to return.

Following unexpected unemployment data in the UK, traders began revising their forecasts and assessing the implications for monetary policy. The unemployment rate increased, contrary to expectations of stability or gradual decline. This has raised concerns about the sustainability of economic growth, prompting fears that the UK economy may be less resilient than anticipated. The Bank of England faces a significant challenge: implementing measures to stimulate the economy while avoiding excessive inflation. Lowering interest rates could help ease debt burdens on households and businesses, encourage consumer spending, and boost investments, thereby supporting the labor market. However, such a policy also carries risks, including a further rise in inflation.

In the second half of the day, all attention will turn to new actions by the Trump administration, as no major economic statistics are expected today.

For intraday strategies, I'll rely more heavily on Scenario #1 and Scenario #2.

Scenario #1: Today, I plan to buy the pound at 1.2260 (green line on the chart) with a target of 1.2318 (thicker green line on the chart). At 1.2318, I will exit purchases and open sell positions, expecting a 30–35 point pullback from this level. A rally in the pound today is only likely after comments from Trump.Important! Before buying, ensure that the MACD indicator is above the zero line and just beginning to rise from it.

Scenario #2: I also plan to buy the pound if there are two consecutive tests of the 1.2225 level while the MACD indicator is in the oversold zone. This will limit the pair's downward potential and lead to a market reversal upward. Growth to the opposite levels of 1.2260 and 1.2318 can be expected.

Scenario #1: I plan to sell the pound after it breaks below 1.2225 (red line on the chart), targeting 1.2180, where I will exit the market and immediately buy back, expecting a 20–25 point rebound. Sellers could emerge at any moment.Important! Before selling, ensure that the MACD indicator is below the zero line and just beginning to decline from it.

Scenario #2: I also plan to sell the pound if there are two consecutive tests of the 1.2260 level while the MACD indicator is in the overbought zone. This will limit the pair's upward potential and lead to a market reversal downward. Declines to the opposite levels of 1.2225 and 1.2180 can be expected.

Beginner traders should make trading decisions cautiously. Before the release of significant fundamental reports, it's best to stay out of the market to avoid sharp price movements. If you choose to trade during news releases, always use stop-loss orders to minimize losses. Without stop-losses, you can quickly lose your entire deposit, especially if you trade large volumes without proper money management.

Remember: Successful trading requires a clear trading plan, similar to the one outlined above. Spontaneous trading decisions based on current market conditions are inherently a losing strategy for intraday traders.

QUICK LINKS