Global markets opened on Monday with new sell?offs in metals, cryptocurrencies, and crude oil, extending Friday's negative trend. What lies behind this, and when will these bearish sentiments end?

First, the move has a very specific character: it looks like plain profit?taking after a prolonged period of gains — as we saw in gold, for example.

When assessing the situation, it's important to remember that even a fundamentally supported, highly demanded asset like gold cannot rise indefinitely. What we are seeing on Friday and again today is a large?scale liquidation that follows the previous month's almost 23% rally. Indeed, it cannot continue forever. The main bearish factor is the same fundamental geopolitical drivers that earlier bolstered demand for gold and other precious metals. Most likely, after slumps in gold, silver and other metals, there will be a phase of consolidation, after which buying will resume.

When will the sell?off end? Gold has retraced roughly 50% on Fibonacci terms relative to the last leg that began last summer, and it has already pulled back to the 38% level. A firm close above that zone would technically signal further recovery if traders again start watching geopolitical developments closely and if Donald Trump continues to stir up issues around Greenland, Canada, Cuba, and so on. Again, the signal that the sell?off is over will be price stabilization near the supply?demand equilibrium. That could occur as soon as tomorrow or the day after.

What can we expect in the markets today? I believe the negative trend will gradually abate in the early North American session, with a consequent consolidation phase. This applies not only to gold, silver, and other precious metals but also to crude oil, crypto assets, and stocks.

Daily forecast

GOLD

Gold is currently trading below $4,683.00. A sustained move above that level could lead to a gradual recovery toward $4,887.00. A suggested buy level is $4,733.45.

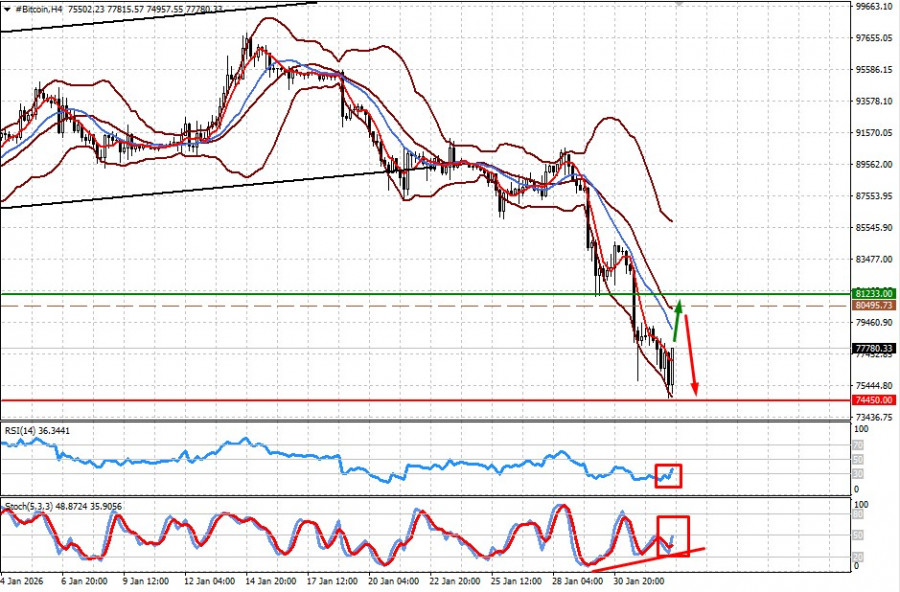

Bitcoin

Bitcoin may partly recover as many short positions get closed, which could push the price up toward $81,233.00. A suggested sell level is $80,495.73.

QUICK LINKS