Praha – Bankovní rada České národní banky (ČNB) dnes projedná nastavení pravidel pro poskytování hypoték a posoudí odolnost českého finančního sektoru. Rozhodne také o stanovení sazby takzvané proticyklické kapitálové rezervy na ochranu úvěrového trhu. Rezerva má zabránit přenosu případných problémů finančních institucí do ekonomiky, od loňského července činí 1,25 procenta.

Secondly, Americans historically vote for the opposition in midterm elections more often. The opposition in the U.S. is gaining traction. It has reached the point where six Republicans have switched sides to the Democrats, successfully blocking Trump's new tariffs against Canada and passing a resolution to end the state of emergency in the U.S., which allowed Trump to impose draconian tariffs on half the countries in the world.

The "six defectors," who Trump has already promised revenge, have shown America that it is possible and necessary to fight Trump, and that Americans are capable of doing so. Economists also note that the middle and lower classes are extremely dissatisfied with the cuts to medical and social support programs. The working class is a significant part of the electorate in any election.

Furthermore, one cannot overlook the United States' growing national debt. Before ascending to the presidency for a second time, the Republican president promised to address the national debt and mitigate the budget deficit. The deficit is indeed decreasing thanks to trade tariffs, while the trade balance deficit is improving due to... a reduction in imports. In other words, the trade balance is becoming balanced not against rising exports (in the context of increasing industrial production) but due to falling imports (because of the trade war). Meanwhile, the national debt could increase by $5 trillion over the next 10 years, considering Trump's expenditures on the military, defense, military operations worldwide, and the fight against illegal immigration.

It is noteworthy that in terms of job creation, American voters still trust Republicans more, despite a significant "cooling" of the U.S. labor market in 2025. Let me remind you that by the end of the year, an average of 19,000 jobs were created each month in America.

Political analysts are doubtful that Trump will lose his advantage in the Senate, but it is still possible. However, the House of Representatives can be said to have already been lost. Losing the majority in the lower chamber threatens Trump with the inability to influence budgetary issues, while losing the Senate would mean losing the ability to appoint his proxies to key positions and make decisions of international significance.

It should also be remembered that Democrats are ready to launch yet another impeachment process against Trump at any time. The opposition is likely waiting until November's elections to strengthen its position. However, a third attempt to impeach Trump seems inevitable.

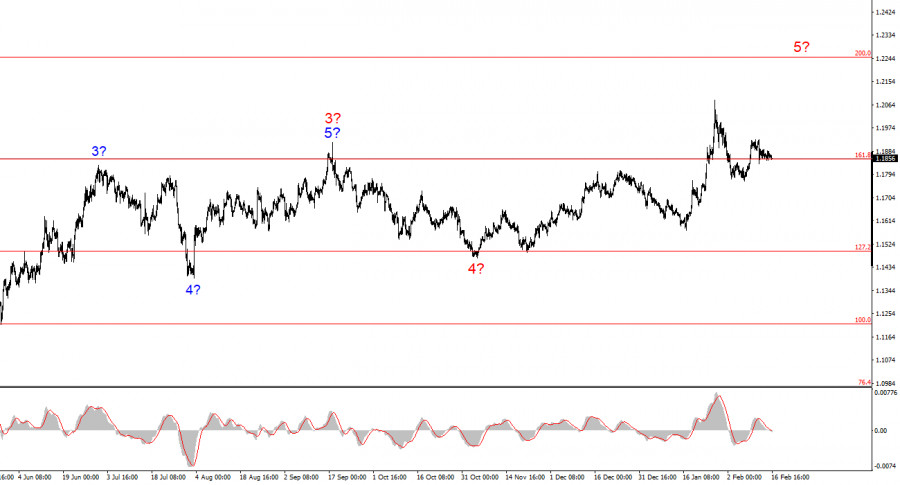

Based on the analysis of EUR/USD, I conclude that the instrument is continuing to build an upward phase of the trend. The policies of Donald Trump and the Federal Reserve's monetary policy remain significant factors in the long-term decline of the U.S. currency. The targets for the current segment of the trend may reach up to 25,000. At the moment, I believe the instrument remains within a global wave 5, so I expect prices to rise in the first half of 2026. However, in the near future, the instrument may construct another downward wave within the correction. I find it sensible to search for areas and levels for new purchases with targets around the marks of 1.2195 and 1.2367, corresponding to the 161.8% and 200.0% Fibonacci.

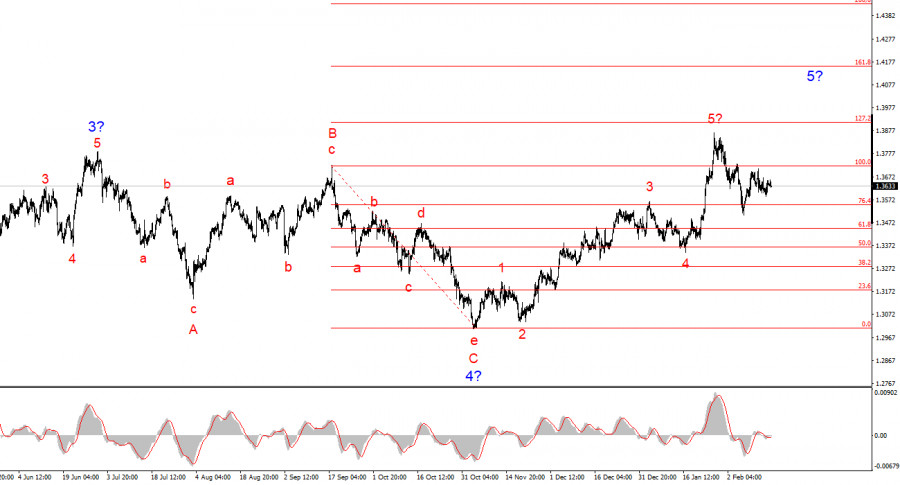

The wave picture of the GBP/USD instrument is quite clear. The five-wave upward structure has completed its formation, but the global wave 5 may take a much more extended form. I believe that in the near future, we may observe the construction of a corrective set of waves, after which the upward trend will resume. Therefore, in the coming weeks, I recommend looking for opportunities for new purchases. In my opinion, under Trump, the British pound has a good chance of rising to $1.45-1.50. Trump himself welcomes the decline of the dollar, and the Fed has the opportunity to lower rates again at the next meeting.

QUICK LINKS