Action equals reaction. The more the White House pressures Jerome Powell, the more he resists cutting rates. The more central banks voice support for the Federal Reserve Chair and the independence of the Fed, the more pressure Donald Trump applies. How the Jackson Hole meeting will end under such conditions, no one knows. Investors prefer to play it safe and avoid rushing ahead. As a result, EUR/USD is swinging back and forth, forming a short-term consolidation range.

Erosion of trust in the Fed and expectations of a renewed cycle of monetary easing in September have so far been the main advantages for EUR/USD bulls. However, at Jackson Hole, central bank governors will likely present a united stance in support of the Fed's independence. They will praise Powell's firmness, which in theory should support the U.S. dollar. If only anyone would listen to those governors. I doubt the White House is interested in the opinions of non-Americans.

What really matters are the rates expected by the futures market. Derivatives are 83% confident in a 25 bps cut in September and are split between two and three Fed easing moves before year-end. If Powell openly resists the political pressure coming from the White House, this could end very badly for the S&P 500 and risk assets overall.

It should be noted that Powell's Jackson Hole speech will be something of a swan song. He is stepping down in 2026, although Trump had urged him to resign earlier. Back in 2020, the Fed Chair outlined in Wyoming a new approach to inflation targeting: 2% was no longer the ceiling, but rather the level around which PCE could fluctuate. Since then, inflation has remained well above that threshold, so the new framework has yet to prove effective.

In 2024, Powell announced the imminent start of a Fed easing cycle, which weakened the U.S. dollar. However, the greenback quickly recovered on expectations of Trump's victory in the presidential election. At the time, investors believed the Republicans' tariffs would crush rival economies and their currencies.

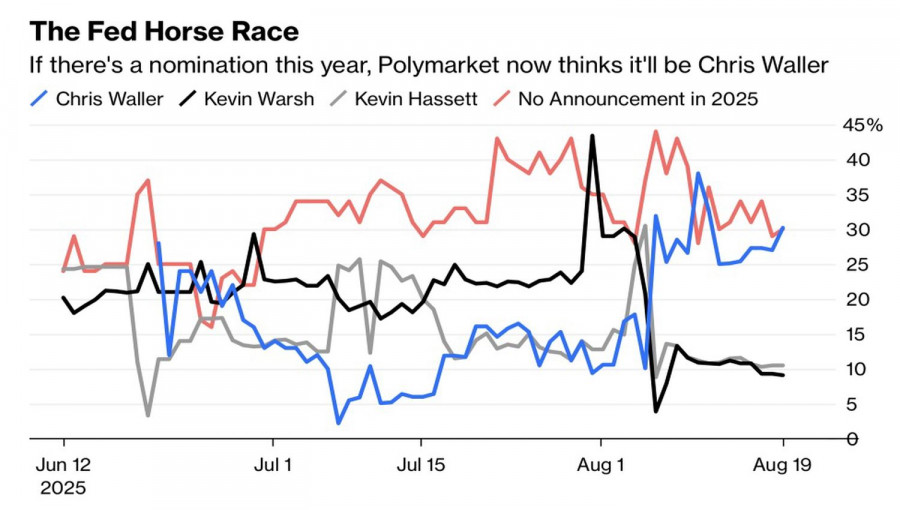

Investors are awaiting Jackson Hole with such impatience that they have almost forgotten about the July FOMC meeting minutes, which will be released earlier. Recall that two dissenters emerged on the Committee. One of them, Christopher Waller, is the leading favorite to replace Jerome Powell.

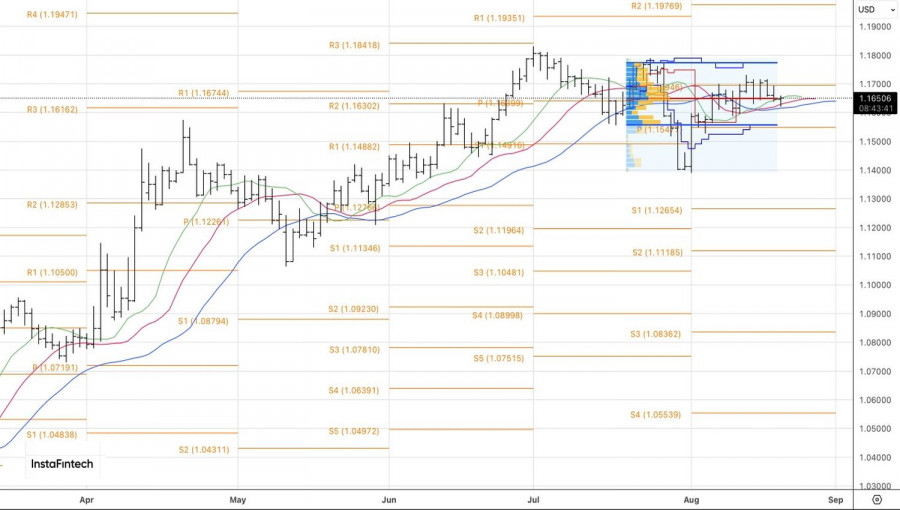

Technically, on the daily EUR/USD chart, the first attempt to break the lower boundary of the short-term consolidation range at 1.1650–1.1715 failed. A successful retest would open the way for selling under the "spike and ledge" pattern. Conversely, a breakout above 1.1715 would provide grounds for buying the euro against the U.S. dollar.

QUICK LINKS