No matter how challenging the current U.S. government shutdown may seem, these disruptions are temporary. This fact, combined with positive news from pharmaceutical companies, has pushed the S&P 500 back toward record highs. Donald Trump announced that Pfizer will introduce new medications in the U.S. at reduced prices. As long as the company invests in the American economy, it will be exempt from tariffs. The White House is also working with other industry representatives to reach similar agreements.

The market hears what it wants to hear. That's why stock indices have continued their rally despite the government shutdown and declining consumer confidence. Previous shutdowns have come at a high cost to the U.S. economy. In Q1 of 2019, GDP contracted by 0.4%, and in 2013, by 0.6 percentage points. Layoffs totaled 340,000 and 800,000, respectively. The current scenario is more reminiscent of the shutdown 12 years ago, which involved a complete halt in executive branch operations. In 2018, however, some programs continued to receive funding.

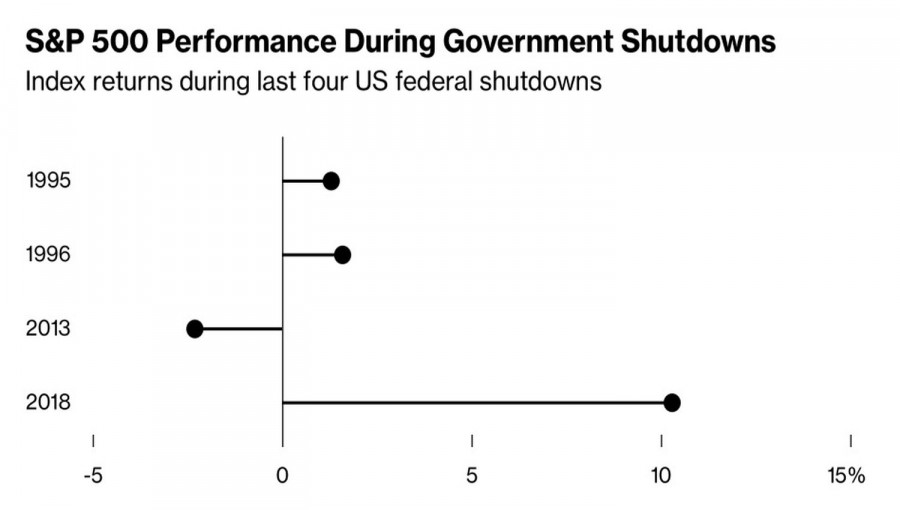

The market's reaction has been mixed. One week before a shutdown, the S&P 500 declined 8 times, with an average drop of 0.1%. After the shutdown ended, the index rose in 11 cases, with an average increase of 0.6%. In four of the last five instances since 1995, government shutdowns actually triggered stock market rallies.

Generally, the longer the executive branch remains inactive, the more damage it does to businesses and the economy. It's essential to distinguish between partial and full shutdowns. The 2025 shutdown is a full governmental stop. Moreover, there is still no visible breakthrough in negotiations between Democrats and Republicans. Bloomberg Economics forecasts a rise in the unemployment rate from 4.3% to 4.7%.

It's not surprising that some bold investors are now discussing a potential pullback in the S&P 500. According to Piper Sandler, a reality check after five straight quarters of growth could push the index down 3–4% and lead to consolidation in the 6400–6700 range. Only after that might the upward move resume. Sanctuary Wealth expects a correction between 5% and 10% if rising inflation in the U.S. leads to a spike in Treasury yields.

These forecasts sound like a lone voice in the wilderness, especially as the S&P 500 retests historic highs. Investors are alert, waiting for the right moment to "buy the dip" and enter into long positions at better prices. Still, a little "ballast drop" wouldn't hurt the index's broader trajectory.

On the daily chart, the S&P 500 quotes have returned to a cluster of pivot levels around 6690–6700. A breakout above this area would signal a resumption of the bullish trend and create an opportunity to add to long positions initiated at 6570 and 6610. On the other hand, a failed breakout would increase the risk of consolidation, prompting many to take profits and potentially reverse positions.

QUICK LINKS