The results of the Bank of Japan's (BoJ) Tankan survey for September, released on October 1, showed an improvement in the business conditions index (DI) by 1 point compared to June for large manufacturers, reaching +14. The index for large non-manufacturing firms remained at a very high level of +34.

Forecasts for capital investment and current profits also remained stable despite tariffs introduced by the Trump administration. This provides a solid basis for expecting another round of wage increases next year, which in turn supports concerns about persistent inflationary pressures.

Overall, the Tankan report contributed to the arguments in favor of a rate hike at the upcoming BoJ meeting, scheduled for October 30.

The primary argument against a rate hike stems from the ongoing U.S. government shutdown, should it drag on. The BoJ is thoroughly assessing the impact of newly introduced tariffs, and to make a well-informed decision, it relies on U.S. economic data, which could be significantly delayed or unavailable during a prolonged shutdown.

Two key reports are especially important: the U.S. nonfarm payrolls report due on Friday, and the September inflation report scheduled for release on October 15. If these reports are not published on time, the BoJ might postpone its rate decision to a later meeting.

These factors introduce substantial uncertainty in projecting the yen's future performance. If the market anticipates a rate hike on October 30, USD/JPY is likely to decline, potentially breaking out of its current range. However, if the shutdown drags on and leads to a postponed rate decision, this could negatively impact the yen and push USD/JPY higher.

For now, markets remain undecided and are waiting for updates. If the shutdown is resolved within 7–10 days, the rate hike scenario will likely regain priority.

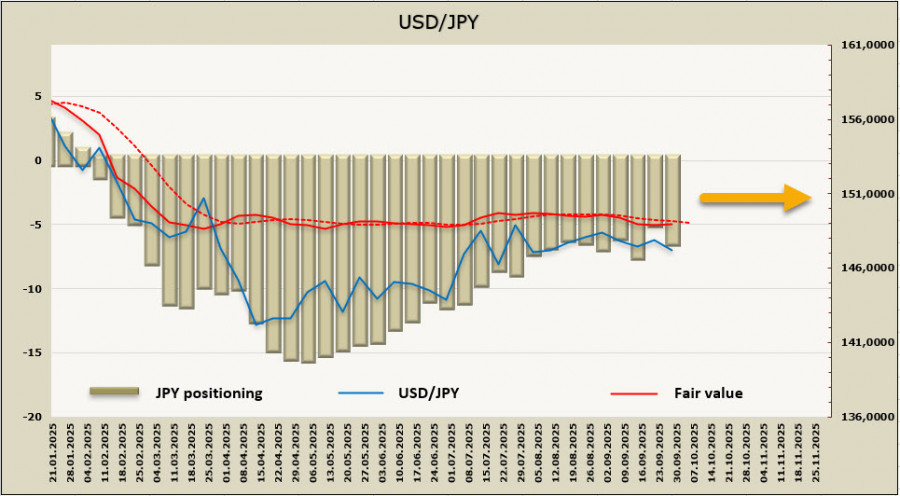

Net long positions on the yen increased significantly by $1.49 billion over the reporting week, reaching $6.73 billion—marking an end to the unwinding trend that began in April. The estimated fair value remains below the long-term average, suggesting continued downside potential for USD/JPY, though the momentum remains weak.

The yen has traded in a narrow range for several months with few signals suggesting a breakout. Markets have long priced in a possible BoJ rate hike in October, and further hints from the central bank are unlikely to shift expectations.

The USD/JPY pair is starting to exhibit a slight bearish bias. For this move to gain traction, two support levels must be broken consistently: the first at 146.40–146.60, and the second at 145.40–145.50. Only then would the technical picture become more decisively bearish—meanwhile, the potential for a return to 150 looks increasingly limited.

QUICK LINKS